Stripe rates for travel businesses

Stripe is widely used in travel. It is fast to set up and works across many currencies.

The challenge is that Stripe rates depend on the region, the currency, and the origin of the card. Stripe does not publish one global price list, so the true cost of a payment is often hard to see.

Below is a practical summary of the Stripe rates that matter for travel designers who collect from international guests and pay suppliers across borders.

Supporting payments with strong systems

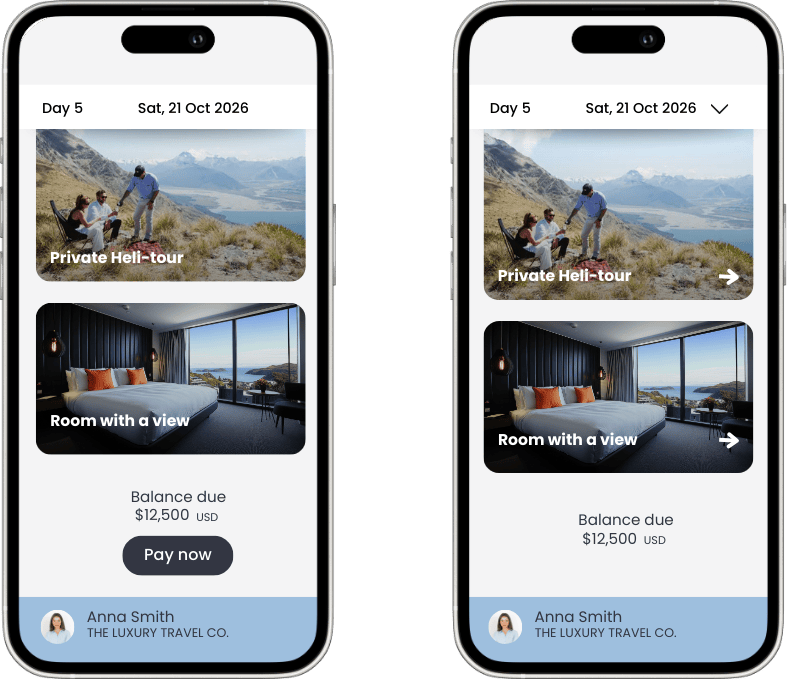

Stripe works best when it is deeply integrated into your customer experience and is a part of a structured workflow. With Tourwriter Payments your travellers can reach a payment workflow straight from their itinerary. You can even control what payment methods they can use, for example do not offer AMEX or only offer bank transfers.

Stripe rates today

Stripe charges different fees based on:

- The country of your Stripe account

- The country that issued the traveller’s card

- The currency used for the payment

- The currency used for settlement or payout

- The card the payment is made from

Each factor creates a separate cost. The below table provides the clearest possible view of them.

| Region | Domestic card fee | International card fee | Currency conversion fee | Payout or settlement conversion fee | Amex fee | Bank transfer fee |

|---|---|---|---|---|---|---|

| United States | 2.9% + 0.30 USD | Approx. +1.5% above domestic for international cards | About 1% when payment currency differs | About 1% plus fixed payout fees | Higher than Visa or Mastercard | ACH Direct Debit ~0.8% (cap). Bank transfer ~0.5% |

| United Kingdom | 1.5% + 0.20 GBP | 2.5% + 0.20 GBP (EEA). Up to ~3.25% + 0.20 GBP globally | About 2% FX conversion | About 1% plus fixed payout fees | Priced in a higher band than standard cards | EUR/GBP bank transfer ~0.5%. SEPA ~0.8% + €0.30 |

| Ireland and Europe (EEA) | 1.5% + 0.25 EUR | 2.5% + 0.25 EUR (UK). Up to ~3.25% + 0.25 EUR globally | About 2% FX conversion | About 1% plus fixed payout fees | Usually priced similarly to international cards | SEPA ~0.8% + €0.30. EUR bank transfer ~0.5% |

| Australia | About 1.7% + 0.30 AUD | About 3.5% + 0.30 AUD | About 2% FX conversion | About 1% plus fixed payout fees | Generally aligned with international rates | Bank transfers around 0.5% where supported |

Get in touch with your Tourwriter account manager to see if you are eligible to negotiate your rates with Stripe or book a some time with our sales team to discuss.

Don’t let slow payments stop a journey. Control payment methods, reduce card fees, and embed flexible payment links in your itineraries.

What each stripe fee actually means

- Domestic card fee

The cost for a card payment when the card was issued in the same country as your Stripe account. This is your lowest possible rate. - International card fee

An extra cost that applies when the traveller’s card is issued outside your Stripe account country. Most travel bookings fall into this category. - Currency conversion fee

A fee Stripe charges when the payment currency does not match your settlement currency. - Payout or settlement conversion fee

A fee added when Stripe converts your balance into the currency of your bank account. - American Express fee

Amex is always more expensive than Visa or Mastercard. Exact fees vary by country. - Bank transfer fee

Stripe supports bank transfer payment methods such as ACH or SEPA. These are often cheaper for large bookings because they use capped fees.

How quickly card payments clear with Stripe

Stripe adds funds to your Stripe balance as soon as a card payment succeeds. Your first payout usually arrives in 7 to 14 days. After that you can choose daily or weekly payouts. Instant Payouts are available in supported regions for an additional fee.

What this means for travel businesses

Stripe’s pricing looks simple at first but travel payments cross borders. It is normal to see multiple fees apply at the same time.

To work with Stripe rates clearly:

- Expect most bookings to use the international card rate

- Expect FX fees when the payment currency and settlement currency differ

- Expect payout conversion fees when money is moved into another currency

- Expect higher fees when several of these layers apply together

How to manage and reduce Stripe costs

- Settle in the same currency you collect in

- Reduce unnecessary currency conversions

- Hold multiple bank accounts in key currencies

- Match your Stripe account settings to your main booking markets

- Offer bank transfer options for large bookings

- Get in touch with your Tourwriter account manager to see if you are eligible to negotiate your rates with Stripe.

Learn more on the Tourwriter payments page.

Stripe pricing sources:

- Stripe global pricing

- Stripe local payment methods pricing

- Stripe currency and FX guide

- Stripe payout documentation

Stripe travel use and reviews: